The Buzz on Property Management San Diego

Wiki Article

The Definitive Guide for Property Management San Diego

Table of ContentsUnknown Facts About Property Management San DiegoA Biased View of Property Management San DiegoSome Known Questions About Property Management San Diego.Some Ideas on Property Management San Diego You Need To Know

This aids make sure that just high-grade occupants are picked, reducing tenant turn over and the linked expenses such as lost rental fee and advertising and marketing costs to find brand-new occupants or the costly process of evicting a poor lessee. Overall, an Indianapolis-based residential or commercial property management firm's knowledge in neighborhood rental market patterns, reliable maintenance and fixing supervision details to climate problems in Indianapolis, and extensive lessee testing process certified with state-specific laws can conserve rental building proprietors both money and time while aiding them stay affordable and bring in premium tenants.

Residential property management business can care for repair and maintenance issues without delay. Otherwise, you may get a telephone call that something has broken down and have to handle it on your own. Expert residential or commercial property administration likewise assists to raise ROI by avoiding lawful problems through conformity aid with both government laws like the Fair Real estate Work as well as state-specific regulations such as the Indiana Landlord-Tenant Act; minimizing vacancy prices with efficient advertising and marketing approaches; and ensuring prompt rental fee collection and decreasing equilibriums owed to you.

From month-to-month monitoring costs to leasing charges and maintenance markups, each fee serves a specific purpose in handling your residential property. It commonly covers the costs of marketing the home, screening potential renters, and preparing lease records.

The Ultimate Guide To Property Management San Diego

Some property administration firms bill a separate charge to cover the expenses of coordinating and looking after home upkeep and repair work. This fee is billed when a tenant renews their lease. It covers the management costs of preparing lease renewal files and performing required evaluations or updates. Are you thinking about working with a residential property monitoring company however unsure regarding the expenses? Comprehending the variables that affect residential property monitoring costs can aid you make an educated decision.When taking into browse around this site consideration property monitoring charges, owners require to evaluate the value the management company gives. Lower costs might not always suggest the finest value, as the high quality of service and the business's track record must likewise be considered.

These charges are considered a needed expense for the operation of the rental residential property, and because of this, they can be subtracted from the rental earnings when determining the taxed income. It's necessary to keep in-depth records of all building monitoring costs paid throughout the year to precisely report these expenditures on your tax return.

Building administration costs and other connected expenses are tax-deductible, assisting to decrease the gross income from the rental residential or commercial property. Furthermore, expert supervisors have the knowledge to guarantee that all eligible expenses are correctly documented and accounted for, making best use of the tax obligation advantages for the building manager. In Virginia, proprietors might be eligible to deduct investment advisory costs from their taxes.

Some Known Incorrect Statements About Property Management San Diego

By leveraging the prospective tax advantages of financial investment consultatory charge deductions, owners can enhance their total monetary approach and improve the profitability of their property investments. Possessing a rental building uses a number of tax benefits that can help you maximize your return on financial investment. One of one of the most substantial benefits is the capability to subtract a broad range of costs related to find this owning and managing a rental property.

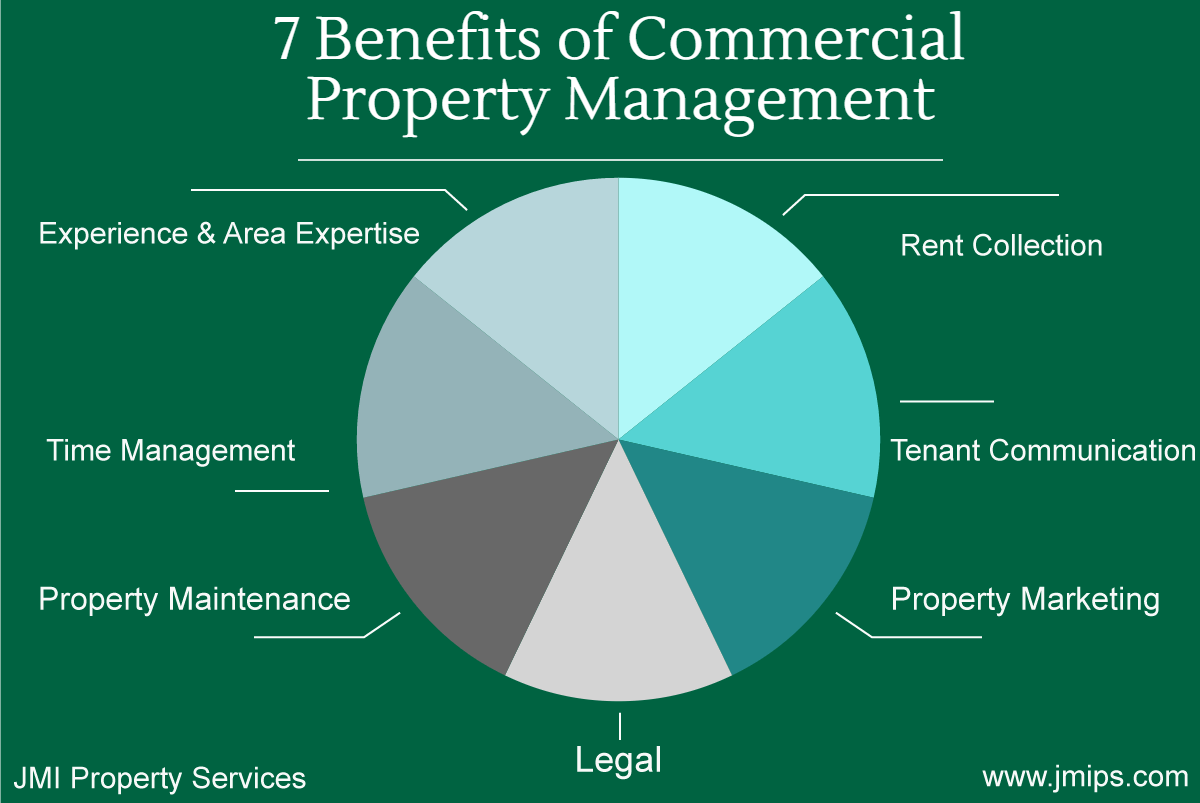

No matter your history, property administration can be a profitable and fulfilling profession choice. Residential or commercial property managers take on the majority, if not all, of a property owner's duties on their part.

Property Management San Diego for Dummies

Demand for building management services is on the increase. This growth suggests that even more people are acknowledging the capacity of the market visit site and jumping in., which reached 986,000 units in 2023, the greatest considering that documents started in 1970.Despite having extensive screening procedures, difficult tenants can sometimes slide through the splits, causing migraines for home managers, proprietors, and various other renters. In one of the most severe instances, this can result in lengthy and irritating expulsion procedures. To successfully take care of lessee demands, issues, and disagreements, property supervisors have to have strong communication abilities and a lot of patience.

As at August 12, 2024, the average yearly income for a property manager in the US is $60,705. On top of the base income, residential or commercial property supervisors can bill monitoring charges based upon a portion of rental revenue and usually earn added earnings from add-on charges and services such as landscape design and consulting. Efficient delegation and automation can help handle workloads, lower after-hours tension, and offer you extra flexibility over when and where you work. Procedures that once took hours or even days to complete by hand can now be done in minutes with home management software.

Report this wiki page